You’ve offered consumer financing from one of the large prime credit lenders for years and feel as though you are competitive by doing so.

Then along comes those consumers (a majority of Americans, by the way) who don’t have prime credit. Being interested in making a sale, you decide to expand your consumer financing offerings by bringing in a no-credit-check or no-credit-required option. After all, this type of program costs you very little, if anything, so, why not – can’t hurt, can it?

There are many options in the marketplace for this type of offering – typically a lease-to-own program. So, now that you have your "alternative" financing program, you are ready to ring the register with sales previously lost from prime credit lender declines.

Not so fast! You see, you have been promoting your 12, 24, 36, or 48 month no interest financing offer. So, when a consumer walks through your door, applies for this attractive offer, and is declined, do you think the 12 month lease that has a cost of payments having an effective interest rate of 65% to 80% will be still be considered attractive? This is what I call "death valley" – a very wide gap between your prime offering and your alternative offering that few consumers will cross, thereby resulting in a lost sale.

Had you been able to offer the consumer an alternative to the prime credit offer that was closer in terms, say 6 months of no interest, or perhaps a more reasonable interest rate of 19.99 to 28.99%, the valley would shrink substantially and more consumers would make it over to this offer.

Driving a consumer through the door is difficult step number one. Then having the consumer mentally-ready to purchase by completing a credit application is difficult step number two. Allowing that mentally-ready consumer in your store to walk out without making a purchase due to a wide gap in financing options is a costly missed opportunity.

Why some retailers balk at these near-prime type of financing options is due to cost. Because of state laws and regulations, the lease-to-own programs are permitted to charge consumers a much higher rate than traditional lenders are able to.

Therefore, the consumer bears the cost of higher default rates, not the retailer. With regulated fees and interest on more traditional financing, such as lines of credit and installment loans, the fees to cover defaults are capped for the lender. Thus, the lender needs to charge the retailer a higher fee to help cover the gap. But, what the retailer gets in return for the higher fees are sales that otherwise would have ended up in death valley!

LendPro works with many home furnishings, appliance, electronics, jewelry, and other big-ticket retailers employing a variety of lender configurations through LendPro's streamlined consumer financing platform. The data collected from the processing of hundreds of thousands of applications each year provide an eye-opening result when it comes to lender selection and configuration.

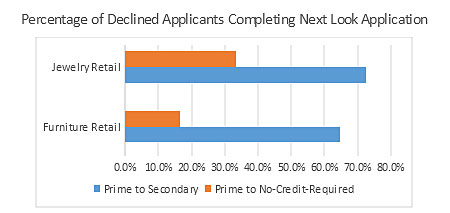

The chart below shows a sampling of both jewelry and furniture stores and the dramatic result of not having a proper "stepping" of financing offers for consumers to embrace.

Don’t let your sales opportunities end up in death valley! Put in to place a smart consumer financing configuration and capture more sales.